Event marketers are spending more to get less. Between 2023 and 2025, customer acquisition costs across B2B channels increased 40–60%, driven by stronger platform competition, privacy regulations, and attribution complexity.

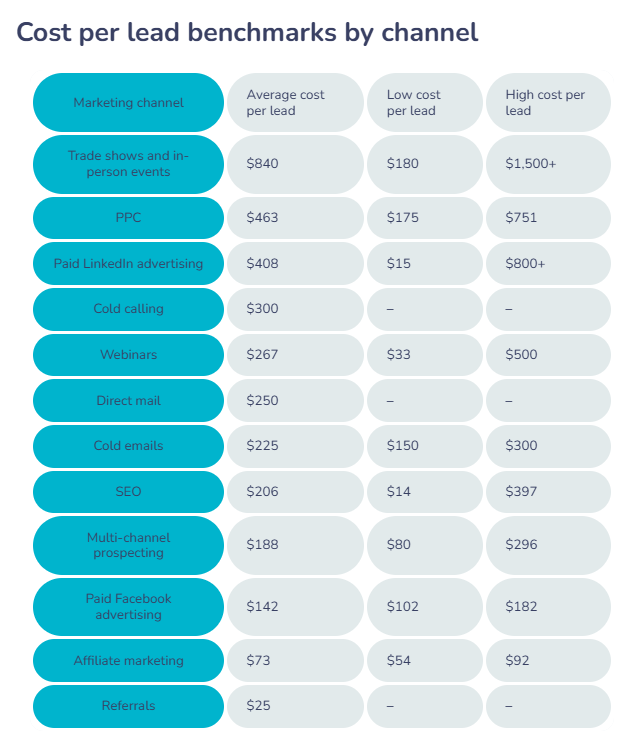

For event promotion specifically, paid channels compound the problem. PPC averages $463 per lead, while LinkedIn advertising – considered the primary channel for reaching B2B event audiences – averages $408 per lead, with costs reaching $800+ for competitive audiences (Sopro, 2025 B2B Cost Per Lead Benchmarks).

Source: Sopro’s B2B cost per lead benchmarks by channel and industry

Traditional event promotion relies heavily on paid channels to reach new audiences. Peer-to-Peer (P2P) marketing takes a different approach: it activates your existing stakeholders (speakers, exhibitors, sponsors, past attendees) to promote your event through their networks.

Because P2P leverages established trust relationships rather than paid media, it offers a potential path to higher event ROI without a significant increase in budget.

Here’s what we will cover:

- Why event marketers face ROI pressure from budget challenges and rising production costs

- How trust has become the deciding factor for selective attendees

- How P2P event marketing tech delivers higher ROI

- What the data says – P2P performs better than paid channels

- Bottomline: Smarter amplification, not bigger budget

Let’s dive in.

Why event marketers face ROI pressure from budget challenges and rising production costs

Event marketing budgets aren’t seeing any significant growth. But event production costs are rising.

The budget reality

Overall marketing budgets have dropped from 9.5% to 7.7% of company revenue over three years, and 59% of CMOs say they lack sufficient budget to execute their strategy (Gartner, 2025 CMO Spend Survey).

Event marketing, while still receiving the highest allocation among offline channels at 19.3% of non-digital spend, faces similar constraints:

- 40% of organizers expect budgets to stay flat in 2026

- 20% expect budgets to decrease

(Source: Bizzabo, 2026 Event Marketing Statistics & Benchmarks)

The cost reality

Meanwhile, production costs continue climbing:

- Average daily cost per attendee reached $169 in 2025, up 4.3% year-over-year (CWT-GBTA, Global Business Travel Forecast via Skift)

- Cost per attendee is projected to rise another 6% globally in 2026 (American Express GBT, 2026 Global Meetings & Events Forecast)

- 38% of planners cite rising costs as their #1 challenge (American Express GBT, 2026 Global Meetings & Events Forecast)

- 71% of meeting professionals expect costs to keep increasing (American Express GBT, 2026 Global Meetings & Events Forecast)

What this does to ROI

When 60% of event budgets are flat or declining and costs rise 6%, your effective buying power drops 6%.

If paid channel CPMs are also climbing (which they are, based on the 40-60% CAC increase we discussed earlier), your cost per registration increases even when you hit the same attendance targets. The math compounds against you.

This makes proving ROI more critical and more difficult:

- 40% of organizers still struggle to prove event ROI (Bizzabo, 2026 Event Marketing Statistics & Benchmarks)

- 22% say getting budget and buy-in is their biggest challenge for 2025 (Swoogo, The 2025 Eventscape)

Why cost-cutting doesn’t solve this

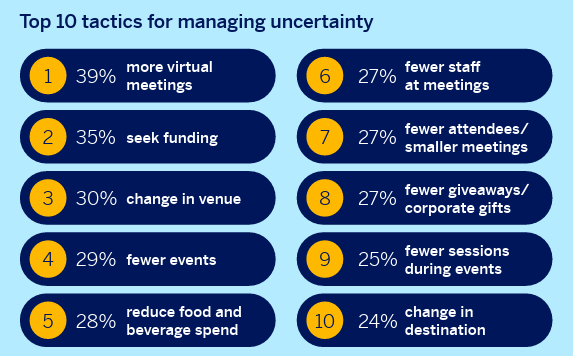

Faced with this squeeze, event teams are cutting where they can:

- 28% are reducing F&B spend

- 29% plan to host fewer events

- Many are cutting breakfasts, décor, scaling back speakers and entertainment

Source: American Express GBT, 2026 Global Meetings & Events Forecast

The problem: You can’t cut your way to registration growth. Trimming attendee experience doesn’t improve acquisition efficiency. It can actually make your event harder to promote, which drives acquisition costs higher.

The real challenge isn’t venue costs or catering budgets. It’s that traditional acquisition channels consume budget without improving efficiency. That’s where P2P marketing creates a different path.

Key takeaway: Events are not losing priority, but flat budgets combined with rising costs quietly erode ROI unless acquisition efficiency improves.

How trust has become the deciding factor for selective attendees

Why does P2P marketing work when traditional channels are getting more expensive and less effective? Because of how attendees now make event decisions.

Event attendance remains 10–12% below pre-pandemic levels, and only 32–39% of events have surpassed their 2019 performance (CEIR Index Reports Q2-Q3 2025 via IAEE/Exhibitor Online).

The decline isn’t universal. Some events are thriving while others struggle, which means attendees haven’t stopped attending events. They’re choosing more selectively.

Greg Topalian, Chairman of Clarion Events North America, put it plainly at a recent Explori/Trade Show Executive webinar: “More than ever, people are looking to feel connected to others with similar problems and similar interests.” His framing of what that looks like in practice is even sharper: “After two or three days in a small environment, you don’t have leads at the end of the event — you have friends.” Watch the full webinar below:

What drives their choices

Commerce is now the #1 reason people attend events, outranking entertainment, experience, and even networking (Freeman, 2025 Commercial Trends Report – Unpacking XLNC). When attendees prioritize tangible business outcomes, they filter harder for events that will deliver results. And they use peer validation to make that assessment.

How peer validation filters attendance

LinkedIn now functions as a qualification layer before registration even opens. Content shared by individuals on the platform carries more weight than brand broadcasts because it’s perceived as peer advice rather than marketing. Pre-event content shared by trusted connections filters ideal attendees by role, seniority, and problem context. (Samaaro, Event Marketing on LinkedIn in 2026).

Why this matters for acquisition

Paid media delivers reach, but trust delivers qualification. When someone sees a paid ad versus when a trusted colleague shares an event, the decision-making process is fundamentally different. Trust acts as a pre-filter: before your marketing message lands, buyers are asking “Did someone I trust recommend this?” If the answer is no, engagement drops regardless of your targeting or creative.

Key takeaway: Attendance isn’t down because people don’t want events. It’s down because people only attend events that trusted peers signal are worth their time. Trust filters attendance before your marketing does.

How P2P event marketing tech delivers higher ROI

Event marketers have always known speakers, exhibitors, and sponsors could drive referrals. The problem was infrastructure.

Without a system to activate advocates at scale, track their shares, and attribute registrations, peer advocacy stayed invisible and unmeasurable. You couldn’t defend it in budget conversations because you couldn’t prove it worked.

P2P marketing technology solves the measurement problem.

Why technology changes the equation

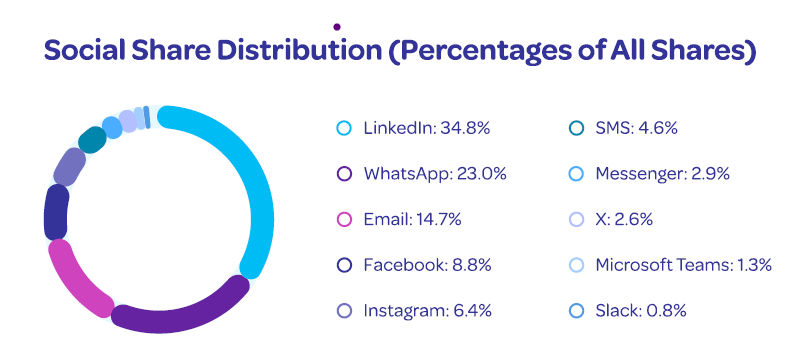

Platforms like Snöball turn stakeholder advocacy into trackable, attributable first-party data. Event teams can now activate advocates with personalized sharing tools, track referral links across channels, and measure attribution including dark social (WhatsApp, direct messages, private chats) where 36.62% of peer-to-peer sharing actually happens (Snöball, 2026 Peer-to-Peer Event Marketing Benchmark Report).

The core functionality includes:

- Personalized landing pages with unique tracking links for each advocate

- One-click sharing across 17+ channels (LinkedIn, WhatsApp, email, etc.)

- Automated outreach campaigns that prompt speakers and exhibitors to share at key moments (speaker confirmation, schedule launch, 2 weeks before event)

- Video invite capabilities for higher engagement

- Real-time tracking showing who shared, where they shared, who clicked, and who registered

What this enables

You can see conversion rate by advocate type, full ROI attribution by channel, and prove which stakeholders drive registrations. When you can show that a speaker’s three LinkedIn shares drove 12 registrations at zero marginal cost, you’ve created a defensible acquisition channel that leadership understands.

The ROI data

HumanX 2025 used Snöball to activate speakers and exhibitors, generating 196X ROI on their P2P platform investment (every dollar spent on the system returned $196 in attributed registration value).

NHS ConfedExpo achieved 6X ROI with measurable registration lift driven by stakeholder sharing (exhibitors and speakers)

This level of performance happens when you give advocates the tools to share effectively and the visibility to track every outcome.

Key takeaway: P2P marketing technology transforms peer recommendations from unmeasured goodwill into a structured, trackable acquisition channel. These case studies above show what this looks like at the event level. The next section shows what the broader benchmark data says across the industry.

Want to estimate your event’s peer-to-peer potential? Snöball’s ROI Calculator lets you model how peer advocacy could impact your registration targets and acquisition costs based on your event size, stakeholder count, and sharing behavior. Check it out!

What the data says – P2P performs better than paid channels

Conversion rates tell the story

Peer-driven social shares convert at 31.9% on average, with top-performing events reaching 53.7% (Snöball, 2026 Peer-to-Peer Event Marketing Benchmark Report).

LinkedIn advertising, as mentioned earlier, averages $408 per lead, with costs exceeding $800 for competitive audiences. Paid channels similarly deliver reach at a rising price. Peer sharing delivers qualified conversions through trust.

When a speaker shares your event to their LinkedIn network, the audience receives three signals:

- Social proof (this person is speaking)

- Implied endorsement (they’re promoting it)

- Relevance filtering (they only share with their professional network)

Trust removes the friction that paid advertising creates.

Attendance contribution without additional spend

Peer referrals account for 6.9% of total event attendees on average, and up to 13.2% at top-performing events (Snöball, 2026 Peer-to-Peer Event Marketing Benchmark Report). This happens without incremental budget because you’re activating advocates you already have access to.

P2P reaches where paid media cannot

Peer sharing concentrates in channels where paid advertising has limited reach:

- LinkedIn: 34.8% (professional credibility, visible endorsement)

- WhatsApp: 23% (private, personal recommendation)

- Email: 14.7% (one-to-one or small group context)

Combined, these three channels account for 72.5% of all peer sharing activity (Snöball, 2026 Peer-to-Peer Event Marketing Benchmark Report). You cannot buy WhatsApp impressions or place ads in someone’s private DMs. When a trusted colleague shares your event there, conversion follows at rates paid channel can rarely match.

The cost structure difference

Paid channels require continuous spend to maintain results. Every registration costs money. P2P platforms operate differently: fixed platform costs spread across an increasing number of advocate-driven registrations. The more stakeholders activate, the lower your per-registration cost drops.

This matters when 45% of event teams operate with just 1–3 people (Bizzabo, 2026 Event Marketing Statistics & Benchmarks) and paid acquisition costs show no sign of declining. P2P scales without proportional budget increases.

Key takeaway: At 31.9% average conversion, P2P outperforms paid channels on the metric that matters most: turning interest into registrations. Peer advocacy offers better performance at a fundamentally different cost structure.

Bottomline: Smarter amplification, not bigger budget

The teams seeing better ROI are working differently. Instead of increasing ad spend, they’re activating the stakeholders already invested in their event’s success:

- Speakers want an audience for their sessions

- Exhibitors want qualified booth traffic

- Sponsors want brand visibility delivered through their package

- Past attendees want peers to share an experience they valued

These motivations already exist. P2P marketing technology gives them the tools to act on those motivations and gives you the data to measure every share, click, and registration that results.

This is what separates P2P from traditional referral thinking. It’s not asking people to promote your event and hoping they follow through. It’s a structured, trackable acquisition channel built on trust relationships that paid media cannot replicate and cannot reach.

When 60% of event budgets are flat or declining and paid channel costs show no sign of falling, the question for event marketers isn’t whether to find a more efficient acquisition channel. It’s how quickly they can build one.

Key takeaway: Event ROI doesn’t improve by spending more. It improves by spending smarter. Activating your existing stakeholders as trackable advocates turns trust into a measurable acquisition channel, one that scales without scaling cost.